"To have, or not to have- that is the question", like Hamlet faced the dilemma on minerals. Geological survey of Finland (GTK) and their Associate Research Professor Simon Michaux faced too, and answered: “World doesn’t have enough mineral reserves for the energy transition”. What's that all about?

Shakespeare aside, in more specific terms GTK describe in their study that: "It is clear that there are not enough minerals in the currently reported global reserves to build just one generation of batteries for all EV’s and stationary power storage." Seems worth checking out.

The report has acquired some high praises in Finnish media and social media. It has been said that: “every decision maker and citizen should read it through”.

|

| Publicity in Finnish social media. |

Internationally it has also got quite a lot likeminded attention from the energy transition and renewable energy skeptics alike.

|

| Publicity in international context. |

Simon himself has been in the Finnish press claiming that “humanity has been taken over by blind faith.”, and: “The claim that technology will safe us, doesn’t respect the reality of mineral resource quantity or their availability.”

|

| Interview article about the study and its findings. |

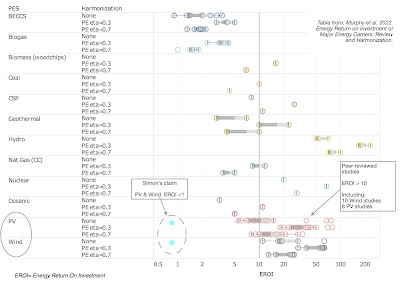

In the same article he claims that “the production, assembly and disassembly of windturbines and solar panels might in theory require more energy than what they produce during their lifetime.”

That would meen an EROI (energy return on investment) of less than one (1) for wind & PV. However, in this recently published literature review and harmonization study of different EROI value studies, wind and PV studies have all the EROI values above ten (10) and averaging around 20.

To me that Michaux claim/ estimate seems bit of an outlier.

|

| Simon's claim compared to peer-reviewed EROI studies. |

I hope I got your attention by now. As they put in this call for action:”It’s time to wake up” So, let’s wake up, and check these numbers because the immediate after question should be: "Yes, but for what?"

Positives from the study:

- Electricity grid flexibility and reliability for seasonal wind & solar intermitted supply cannot only rely on batteries. >> That's why it's rarely suggested.

- The call for open discussion about understanding the transition and its requirements.

Don’t get me wrong. This study must be taken seriously because it comes with such a strategic magnitude. This is a wakeup call to mineral reserves and their development, but it is counter-initiative to come up with such exaggerated claims. You can do better, GTK.

First study and its shortcomings

The first report was published on August 2021 and has 985 pages but there are NONE explicitly stated mineral requirements for transition. Still they claim to know best the energy transition mineral requirements. That should make one consider, shouldn’t it.

Only one graph, page 651 states that the we will run out of mineral reserves. It’s based on assumption that we need a 574 TWh of stationary battery storage for intermitted energy production (wind & solar). Electric vehicles make only 10% of that cumulative amount.

|

| The only graph about mineral requirement quantity in a 1000 page study. |

The first report estimates were only based on NMC-811 battery chemistry which seems less likely primary chemistry, especially in stationary storage.

We critizised this, and other assumptions in September with @T1Heikkila and @MattiKahra in Finnish opinion article.

How much more 574 TWh is than the others predict?

- IEA NZE Scenario 2050

- 3,86 TW of power

- 6h storage= 23,2 TWh (range from 1-8h)

- wind & solar share 69% - S&P estimate is around 8,1 TWh.

- BNEF estimate 4,5 TWh

That is not a modest estimate.

|

| GTK stationary battery storage estimates compared to others. |

U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) has published a study (2022) which claims that US can reach 94% of RE-share with 6 TWh and 930 GW stationary battery. Wind & solar share is 71%. That means only 6,5h of stationary battery storage capacity.

GTK's study fails to look the seasonal storage from global perspective, with all the geographical variations. Most of the people live in southern latitudes, where seasonal intermittency of solar, for instance, is less of an issue. Map: @undertheraedar

|

| Population density by latitude @undertheraedar. |

Why is GTK's estimate is so much off from the others? - They assume that we need a FOUR-week stationary battery (672h) for wind and solar power. Here's a study that estimates that li-ion batteries are pricewise optimal for only less than 16h of storage, in 2040.

|

| Electricity storage lifetime cost comparison. |

Wouldn’t it be odd if we used only batteries to mitigate electricity grid flexibility. The World Energy Outlook 2022 offer much more holistic approach to this matter. Batteries account only 15-25% of the flexibility demand by 2050 in different scenarios.

|

| Batteries account only 15-25% of the grid flexibility according to IEA. |

Seems like something is missing from this “overall mineral requirement study” that the others take into account, but I’m afraid to say that this is not the end of it. There’s another, even bigger elephant in the room, which you might have noticed. In fact, couple of them.

The unpublished 2nd study

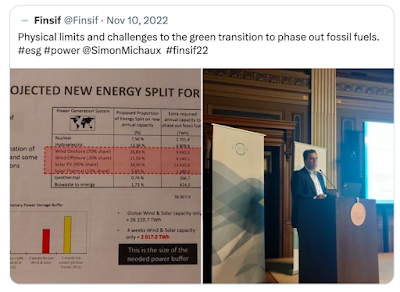

The second part of the study comes with even bigger number of stationary battery storage= 2017 TWh. The main reason for this is a 3,5-factor increase in wind & solar share, and the assumption of the global 672h of stationary battery storage still remains.

|

| Second study has not been published yet. |

Like the first part of the study, 2nd has not been peer-reviewed. In fact, it has not even been published… Most of these online circulating mineral requirement claims are based on the presentation set. That’s where I got these numbers, too.

Youtube presentation: https://www.youtube.com/watch?v=MBVmnKuBocc

Professor Eliot Jacobson praised this 2nd (unpublished) part of the study as a: "Proof that green energy transition is a bright green lie." So let's have a look at the numbers.

|

| Eliot Jacobson's twitter post about unpublished study. |

The main reason for inflated mineral requirements is the increase in Renewable energy production (mainly wind and solar). That puts this 2nd (unpublished) study more in-line with other RE-scenarios. The changes between 1st and 2nd study in production estimates are large.

The additional power estimate difference between the studies from 2021 and 2022 are:

- Wind increases 168%

- Solar increases 497%

- Nuclear decreases -75%

- Hydro decreases -71%

So much so, for the energy transition predictability, I guess.

|

| Differences between GTK's first and second (unpublished) study. |

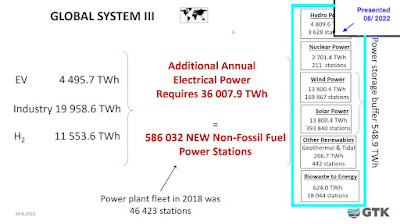

For instance, why annual nuclear generation decreases by almost 8000 TWh? That’s almost 500 Olkiluoto 3 sized (1600MW) reactors gone. Here are the original tables.

|

| 1st study electricity generation mix. |

| |

|

The 2nd study leaves us with the 27 600 TWh of wind & solar generation which based on their study requires FOUR weeks of 2017 TWh of stationary battery storage. Only now we can deal the mineral requirements because they are so heavily influenced by these assumptions.

As a sidenote, I don't have time to check every mineral requirement of every technology but seems like Michaux mostly refers to IEA data. However the EV battery metal requirement estimate comes with some peculiarities.

For instance, the EV battery minerals quantities seem quite inflated in comparison to IEA battery chemistry predictions assuming "2030 Constrained-scenario". Lithium:

- Michaux 14kg/EV

- IEA 7kg/EV

>>>That's 100% more! These things matter when predicting 66 TWh of batteries.

|

| EV battery chemistry difference between IEA and Michaux. |

EV battery mineral requirement is not the main issue here, however. It is the battery storage, as you might have expected. Most of the stationary storage is based on LFP but other chemistries exist too. Let's take a closer look how it affects the copper demand estimation.

|

| Stationary battery storage chemistry compostion in the 2nd study. |

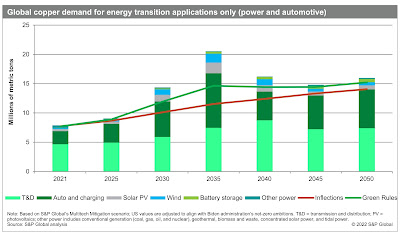

Copper estimate has 4576 Mt total cumulative copper demand in GTK 2nd study. Out of this, stationary battery storage requires 4370 Mt, which is 95,5% of the total amount. All the other technologies require only 4,5%. -I mean all.

|

| Michaux's cumulative copper demand share estimate. |

Here’s a graph from S&P The Future of Copper study (2022) which estimate the copper demand for stationary battery storage quite another way around. The biggest copper demand share in S&P prediction, Transmission & distribution is missing from GTK’s mineral estimate.

|

| S&P copper demand estimate between applications. |

Analysing the previous graph year 2040 estimate in similar pie-chart fashion. Stationary storage requires only 2,3% of the total copper demand from energy transition technologies in 2040 based on S&P.

|

S&P cumulative copper demand estimate. |

How about IEA vs GTK. What is the difference between them? when we:

- Have the IEA NZE 23,2 TWh battery storage

- Have IEA EV battery mix in IEA estimate

- Have IEA EV battery mix in IEA estimate

Keep every other technology mineral requirement/MW the same? Surprise, global copper reserves are adequate.

|

| Copper reserves and cumulative copper demand estimate differences. |

Like shown before, an important thing seems to be missing from GTK copper demand, the electricity grid. According to IEA grids are the most copper heavy transition application and require up to 4,9 to 10,1Mt annually by 2040. That's 250 Mt cumulative.

Also, what points out to me in the prof. Jacobson table based on Michaux study is the Vanadium demand and the claim that we have only 3,52% of the required vanadium reserves. So, what's that all about?

|

| GTK's cumulative vanadium demand estimate (t). |

According to the 2nd study world will have 66,3 TWh of vanadium redox flow batteries (VRB). While, VRB batteries offer some advantages to li-ion they are not there, yet according to this article. That amount is comparible to total global EV-fleet demand. Seems a bit excessive.

IEA and GTK cumulative mineral demand differences

Okay, let's stop messing around. Let's compare IEA NZE scenario and GTK (2nd-scenario) energy additions, and mineral requirements. IEA scenario produces 70% more electricity. In other words, IEA plan replaces the current system 1,7 times more than GTK study.

|

NZE electricity generation difference between IEA and GTK estimates. |

Let's assume that GTK's mineral values for electricity generation technologies are correct. Process: Previously shown electricity generation differences between the scenarios are factored and the GTK's mineral assumptions are multiplied by this factor for IEA NZE requirement demand. For instance, IEA’s wind power generation additions are 1,59 times the GTK’s, so in this model the GTK’s wind power mineral requirements are multiplied with the factor.

Differences are quite substantial.

IEA’s NZE scenario metal requirements are enough for more than two transitions.

GTK's 4-week stationary storage assumption inflates the critical mineral requirement by a factor between 26-83 times. That's how they claim what they claim.

|

Cumulative mineral requirement differences. IEA NZE 2050 versus GTK (MIchaux, 2022) 2nd study. |

Here are the references and sidenotes to the previous table 1A.

|

Notes & reference to table 1A. |

Out of general curiosity, let's also add another scenario with 12h of battery electric stationary storage (BESS) based on the IEA NZE scenario 3,86 TW of power. That makes 46,3 TWh of stationary battery storage.

This is how the cumulative mineral requirement scenarios look visually. Including:

- Identified mineral reserves

- GTK’s 2nd study scenario

- IEA NZE scenario (6h BESS)

- IEA NZE scenario (12h BESS)

Bear in mind that IEA scenarios has 70% more electricity than GTK.

|

Cumulative mineral demand differences between the studies and global identified mineral reserves. |

Concluding remarks

To sum this up, let's visit the original claim, once more: "It’s time to wake up - The currently known global mineral reserves will not be sufficient to supply enough metals to manufacture the planned non-fossil fuel industrial systems"

To me the way that they have run the research and have published the studies seems like an effort to directly downplay to energy transition technological opportunities. It’s neither in line with stated motivation: "Increasing the mining and recycling of minerals greatly"

|

Screenshot from Wake Up -page (November, 2022) |

Another claim: "The World needs a new plan"

No, we don’t need "a new plan" or even a breakthrough in technology. Plans and technologies continuously evolve and naturally develop according to market needs with the free & open market, and research-based insights.

We don’t need the wishful blue-eyed thinking that some new out-of-the-blue-technology might in decade or two emerge and save us all, if we keep our fingers crossed.That’s how we ended up in this mess in the first place.

We need concrete development.

We need to rapidly extend the deployment, production and development of the existing zero-emission technologies, and materials & minerals associated with them. We need adaptabilty in their application for different energy markets, energy mixes, and geographical seasonalities.

Market has a built in mechanism to deal with the mineral shortages, if they occur, and that is, the high prices. Bottlenecks tend to fix themselves. High prices increases the development of primary and secondary mineral processes and hopefully product design, too.

It's worth considering the material and mineral externalities on Earth while transition pace increases. Then one must consider the mineral extraction of other metals, fossil fuels etc. today. Which leaves us, in fact far better off than previously.

|

| Mineral extraction compared to other extraction. |

Thanks for tuning in.

Author: Visa Siekkinen

Originally posted as a twitter thread.

19.11.2022

References

[1] Geological Survey of Finland. (2022). It’s Time to Wake Up. Available at:<https://www.gtk.fi/en/research/time-to-wake-up/> [Accessed 19 November 2022].

[2] Hanley, S. (2021). Researchers Claim Redox Flow Battery Breakthrough Will Cost $25 Per KWh Or Less. Cleantechnica. Available:<https://cleantechnica.com/2021/01/25/researchers-claim-redox-flow-battery-breakthrough-will-cost-25-per-kwh-or-less/> [Accessed 12 February 2023]

[3] Heikkilä, T., Kahra, M., Siekkinen, V. (2022). Asiantuntijat tyrmäävät kiistanalaisen raportin: ”Kaivosmineraalit riittävät vihreään siirtymään”. Kauppalehti. Available at:<https://www.kauppalehti.fi/uutiset/asiantuntijat-tyrmaavat-kiistanalaisen-raportin-kaivosmineraalit-riittavat-vihreaan-siirtymaan/3dda7119-b84a-45f7-a59e-770d6525c241> [Accessed 12 February 2023].

[4] IEA. (2022). Demand for copper and aluminium for electricity grids in the Sustainable Development Scenario, 2020-2040. Available at:<https://www.iea.org/data-and-statistics/charts/demand-for-copper-and-aluminium-for-electricity-grids-in-the-sustainable-development-scenario-2020-2040> [Accessed 12 February 2023]

[5] IEA, b. (2022). The World Energy Outlook 2022. Available at:<https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf> [Accessed 12 February 2023]

[6] Jorgenson, J., Frazier, A. W., Denholm, P., Blair, N. (2022). Storage Futures Study. Grid Operational Impacts of Widespread Storage Deployment. NREL, National Renewable Energy Laboratory. Available at:<https://www.nrel.gov/docs/fy22osti/80688.pdf> [Accessed 12 February 2023].

[7] Michaux, S. (2021). Assessment of the Extra Capacity Required of Alternative Energy Electrical Power Systems to Completely Replace Fossil Fuels. Geological Survey of Finland (GTK). Available at:<https://tupa.gtk.fi/raportti/arkisto/42_2021.pdf> [Accessed 12 February 2023]

[8] Michaux, S. (2022). Assoc Prof Simon Michaux - The quantity of metals required to manufacture just one generation of renewable tech. Youtube. Available at:<https://www.youtube.com/watch?v=MBVmnKuBocc> [Accessed 12 February 2023]

[9] Murphy, D.J., Raugei, M., Carbajales-Dale, M., Rubio-Estrada, B. (2022). Energy Return on Investment of Major Energy Carriers: Review and Harmonization. Sustainability, 14 (12).

[10] Schmidt, O.,Melchior, S., Hawkes, A., Staffell, I. (2019). Projecting the Future Levelized Cost of Electricity Storage Technologies. Joule, 3 (1), pp. 81-100.

[11] S&P Global. (2022). The Future of Copper. Available at:<https://www.spglobal.com/marketintelligence/en/mi/info/0722/futureofcopper.html> [Accessed 12 February 2023]

[12] Westrén-Doll, J. (2022). Irti sokeasta uskosta. Helsingin Sanomat. Available at:<https://www.hs.fi/visio/art-2000009037120.html> [Accessed 12 February 2023].

Comments

Post a Comment