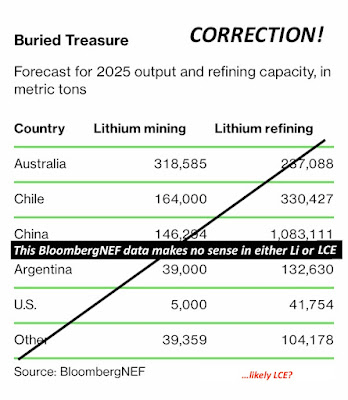

Short correction to the @BloombergNEF lithium mining estimate, and to my I yesterday's tweet.

Instead of 712 kt of (Li), it seems that the actual mining forecast is around 240-260 Kt of Li tons.

>>> Enough for around 30 million EVs.

|

| BloombergNEF lithium mining and refining forecast from the article. |

That being said, the key take away from yesterday's tweet is also incorrect. Lithium mining will not meet the 4,1 TWh battery manufacturing demand forecast (by BNEF), which now also seems inflated.

|

| My earlier post based on BNEF forecast. |

BNEF 07/2022 Li mining forecast seems to be quite far off from other estimates.

I was mistaken by the @paola_rojas tweet where Li tons were used, but BNEF estimate is likely in LCE tons. If the BNEF Li mining forecast is in LCE tons, there would be no growth from 2022-2025:

690 kt >>> 712 kt, which is untrue according to others.

Australian government predicts a domestic production growth from 335 (2022) to 470 kt LCE by 2024.

@BloombergNEF article's AUS 2025 forecast is smaller than the AUS production last year (2022).

|

| Australian government lithium export estimate until 2024. |

LCE= Lithium carbonate equivalent (18,8% Li).

BNEF Chile and Argentina lithium predictions make no sense either. BNEF estimates🇨🇱 164 kt and 🇦🇷39 kt respectively. Other sources 2025: 🇨🇱 250 kt LCE, 🇦🇷 175 kt LCE.

|

| Argentina lithium production estimate. |

|

| Aus gov lithium production estimate until 2024. |

|

| Mckinsey production estimate until 2030. |

Many others like @GlobalXETFs expect lithium demand to be 1500 Kt LCE, 2025.

|

Remarks:

1. BNEF June/2022 estimate seems incorrect/ outdated

2. Lithium mining is growing rapidly but the supply is not yet guaranteed for the near future.

>>> Let's not get ahead off ourselves.

Visa Siekkinen

Original thread:

https://twitter.com/VisaSkn/status/1622669437957545996?s=20

Comments

Post a Comment